The Debt Ceiling Dance (No Twerking, Marj)

From the time George Washington raised his right hand and swore to support the Constitution and get better dentures, until right now, the country has been in hock. After getting us out of debt, Old Hickory could concentrate on his benevolent treatment of Native-Americans - like the Trail of Tears.

Oh, children, there's a storm a'brewin'. A veritable Texas chainsaw, barbed wire death match. And it's all over something we have lived with for all but one year in the history of the land of the free. And that thing is debt.

That's right, except for one year, 1835, when President Andrew Jackson dissolved the 2nd National Bank of the United States and turned all the country's original investment back to the treasury, the US has had a national debt. From the time George Washington raised his right hand and swore to support the Constitution, and get better dentures, until right now, the country has been in hock to a greater or lesser extent. And, of course, after getting us out of debt, Old Hickory could concentrate on his benevolent treatment of Native-Americans, you know, like the Trail of Tears.

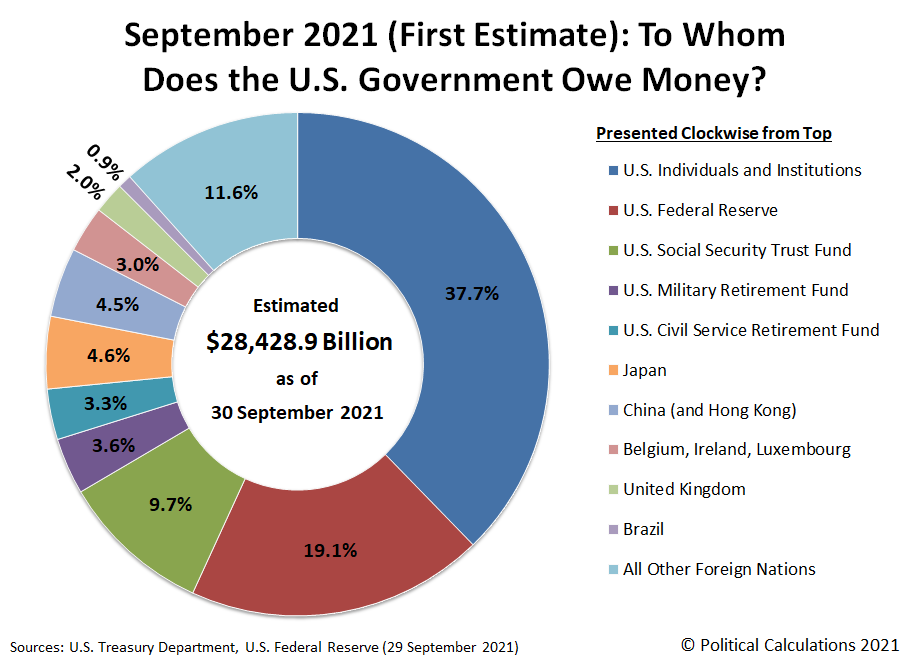

We accumulate debt by selling Treasury Department financial instruments, sort of huge international US Savings Bonds. And somewhere down the road, they mature and we pay them back. Who buys them? Well, Japan, China and the UK are our major foreign creditors, along with a host of other countries, right down to the Bahamas. We also sell it to domestic buyers as well like banks and retirement funds.

And since 1917, we have apparently been under the delusion that setting a limit on it was a dandy idea. Thus came into being the debt ceiling. And other than Denmark, we are the only country that thinks these semi-annual food fights are a cracker jack way to run an economy. And Denmark doesn't use it like Lucy with the football.

Now the debt ceiling doesn't raise the amount of debt we have. It allows us to pay off what we have already spent. Any political carnival barker who tells you otherwise is either, A-lying or B-thinks the thermometer gave you that fever.

But every time it comes up for a vote, it's becomes this weird dance where one party portrays itself as an economic Hester Prynne fighting off the spendthrift advances of those profligate Arthur Dimmesdales in the other party. As an aside, I think the Scarlet Letter took me one metaphor too far, to be honest.

Now, I have outlined how laughable these party self-descriptions are in an earlier essay, and their wacky pranks on the economy from supply-side to all the other theories that appear to have been dreamt up by Stan and Ollie. But unfortunately, some GED holders in Congress still believe them. They are in need of ESL classes, Economics as a Second Language. But whomever you think is a better steward of our dollars, the debt ceiling must be raised and our debts honored. The Constitution says so.

But now we are engaged in another hostile tango between the President and Congress, and the House of Representatives, mainly, is threatening to hold up the debt ceiling talks until they get something. The difference now versus 2011, when real damage was done to our credit rating is, they don't know what they want. President Biden has presented a budget plan, which like all presidential plans is dead on arrival. But it is there. The invertebrate Speaker of the House, still wants to hold talks, but won't say what he wants. It's like a kidnapper sending a note saying "I have your kid. Give me, oh, I don't know, something or something will happen, sort of."

Now we could waste a lot of time going back and forth on why the former President didn't have these challenges, or how Democrats do the same thing, which they do. We all know that and wasting time chronicling our petty, partisan spitball fights will take up precious internet space here that we could use for our own petty spitball fights.

Oh, the problem could be solved easily by Congress. They should abolish the debt limit and replace it with the simple, common-sense rule that automatically authorizes any borrowing necessary to implement any fiscal legislation that affects the federal deficit. This “Gephardt rule,” named for former Majority leader Dick Gephardt, was in place at various times in the past. But come on, that's no fun. And then they'd have to wait for actual budget debates to, uh, debate the budget.

But here's a novel idea. The President simply raises it himself, and all by himself. I mentioned the Constitution, so here is the 14th Amendment, Section 4...

The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned. But neither the United States nor any State shall assume or pay any debt or obligation incurred in aid of insurrection or rebellion against the United States, or any claim for the loss or emancipation of any slave; but all such debts, obligations and claims shall be held illegal and void.

Now, the second half of that is regarding the former Confederate states and says, essentially, you guys wanted a war so now pay for it yourselves. Oh, and too bad about those slaves you lost. But the first part is binding. We honor the debt, no ifs, ands or buts. It isn't even to be questioned.

So, the theory goes, if Congress wants to question it, or worse, not pay it, the executive will have to. Now, Article 1 of that same document gives Congress the power of the purse, and there would undoubtedly be a constitutional crisis. But let's compare that to not raising the debt ceiling.

According to Washington Monthly magazine, "Last year, Moody’s Analytics chief economist Mark Zandi predicted that a default “would wipe out as many as 6 million jobs and erase $15 trillion in household wealth.”

There was a small, inadvertent default on a small portion of our debt, about $120 million, back in 1979. It was explained in an NPR interview that a computer glitch of some sort, was the cause.

However, professor Richard Marcus of the University of Wisconsin, Milwaukee, did some research and concluded that the default of 1979 raised the interest rates that the government had to pay on their securities by about six-tenths of 1 percent. Six-tenths of 1 percent - not on the $120 million, but on the entire nearly trillion dollar debt. And so six-tenths of 1 percent of a trillion dollars is around $6 billion a year on a $120 million mistake. And those were '79 dollars.

Well, the debt is now about $31 trillion, and the results of a default are too awful to consider. The Brookings Institution says...

If the debt limit were not raised, the amount of spending cuts or tax increases that would be required would equal $1.5 trillion this year and $14 trillion over the next 10 years. For perspective, these figures are larger than total defense spending over the same periods of time. And if there were a default, interest rates would rise, increasing deficits and requiring even larger tax and spending changes.

So, fight over the 14th Amendment in the Supreme Court, or another Great Depression? H-m-m. Let me think about that for a nano-second.

And we risk this because, like every one of these fights in both parties, one side says we are spending too much and is willing to risk all this to make their point. Never mind that we have gone through big spending periods, like the last administration, with nary a peep as $7-trillion of that $31-trillion was accumulated, the largest single chunk of debt in any 4 year span.

Look, if you want to get the debt down, a noble cause I heartily support, do so. But this is a bridge too far, a risk not worth taking. Let the handful of grownups still holding elective office gather in a room and hammer out a spending and tax policy that works. It will be long and slow, but men and women of good will can make it happen without these games of economic chicken.

Did you read that previous paragraph? It's absolute nonsense and sounds like dialogue for Jimmy Stewart. I fear there are no grownups left and even so, before they could get anything done, they would be zip-tied by a guy with face paint and buffalo horns.

Now, he is part of the Texas Outlaw Writers, and if this doesn't pan out, the outlaw part will still work as he will indeed resort to robbing banks.