Apocalypse...Uh...Not Now. Somewhere Down the Road

It's been a heck of a week, Brownie.

"We elect Democrats to give us stuff and Republicans so we don't have to pay for it." - Molly Ivins

"He was born on third base and thinks he hit a triple." - Ann Richards

They call it the "Big, Beautiful Bill" as a craven tribute to Donald Trump's florid rally rhetoric. And it again exposes the myth that there is a fiscally responsible political party in this country. There isn't.

Oh, voters thought they were electing one.

Donald Trump had built a reputation as a successful businessman, a tycoon for whom the "art of the deal" was a mantra and Republicans were the "no dessert until you eat your peas" party. He was a spiritual man who would dig us out of a mountain of debt, relegate godless liberals to the back benches of government and return us to the good old days of moral clarity and economic probity.

Well, he won't. Morally, Trump is a serial philanderer who cheated on all his wives and his career in business has been frankly, a financial Chernobyl. As The Ticker explained...

Trump Shuttle Airlines failed after two years, with a plane crash in the first two months. Trump Mortgage lasted a year and closed in 2007 due to the fact that Trump’s hired executive, E.J. Ridings, significantly inflated his resume. Trump Steaks failed, Trump Magazine failed, GoTrump.com failed, Trump The Game failed, Trump Vodka failed.

Trump University failed with a $40 million lawsuit from the New York Attorney General. Trump Taj Mahal, Trump Plaza Hotel, Trump Casinos Resorts and Trump Entertainment Resorts all filed for bankruptcy.

Trump’s business decisions have been so wary, Forbes reports that if he had just invested his inheritance into the S&P 500, an index fund, he would be $400 million richer today.

He may not really be a successful businessman, but he played one on TV.

Now, we all understand that when there are national emergencies, recessions, wars and the like, money must be spent. But when the crisis is over, it only makes sense to return to a more sensible fiscal policy. Or, just pay for the money you just borrowed, like I and probably most of you are doing every month on a mortgage.

The World Wars, Korea and Viet Nam were examples and the recessions that followed, another. The Great Depression, 1977 OPEC embargo, the Middle East wars, the 2008 recession and the 2020 pandemic, all moments of truth. We get it, and the public expects government to respond during these times. That's why it is not like a private business. When times are tough in the business world, you pull in your horns and trim expenses. Staff may be cut along with advertising.

In government, when times are tough, people need help and the demand for services usually increases. That's how it works, and if you have to borrow money for a time, so be it.

But when the emergency is over, it's time to return to some semblance of normality. For that part, we have lost the instruction manual.

I have mentioned, probably too many times, that we last balanced the budget, indeed generated a surplus, in 1998-2001. It took some heavy lifting for both parties, tax increases, budget cuts, but it was accomplished. We were in the black, had $559 billion in surplus money to reduce the debt, which was only $5.5 trillion in 1998. Within a few years, we could have been a nation that was debt free. The main factors at play then...

- Economic Factors: The strong economy generated high tax revenues, which, combined with spending restraint and capital gains tax revenue, resulted in the surplus.

- Tax Policies: Tax increases on the wealthiest Americans and capital gains tax revenue also contributed to the surplus.

- Future Impact: The surplus helped to reduce the national debt and paved the way for future fiscal stability.

Then, we forgot how to do it.

When you or I get a raise at work, we now have extra money. Do we repair the car, pay down credit cards or go out and buy a boat?

Well, as nature abhors a vacuum, Congress abhors a surplus. George W. decided to cut taxes, and we went into the red again, and the debt began to climb. And just like you and I, when you are in debt, it's a strain to handle a big emergency, illness, a car breakdown, storm damage to your house. When the 2008 recession hit like that storm, Bush and then Obama had to pay the freight for a recovery.

Then, in 2017, President Trump decided another tax cut was in order. Were Americans complaining about their tax burden? It really doesn't matter because he did it anyway. The Congressional Budget Office said it would cost about $2 trillion over ten years in government revenue and the benefits were not shared by all.

Households with incomes in the top 1 percent will receive an average tax cut of more than $60,000 in 2025, compared to an average tax cut of less than $500 for households in the bottom 60 percent, according to the Tax Policy Center (TPC). As a share of after-tax income, tax cuts at the top — for both households in the top 1 percent and the top 5 percent — are more than triple the total value of the tax cuts received for people with incomes in the bottom 60 percent.

Did the upper income groups need this relief? Was it worth the additional debt during his first term: $8.4 trillion in that 4 year span? Of course, $3 trillion of that was for the pandemic, as was $4 trillion spent by Biden as Covid wound down.

That was another emergency we needed to prepare for. It would have been easier with more revenue in the till.

And every time, since the Reagan tax cuts in the 80's, Republicans tell us the economy will boom and the cuts will pay for themselves. They never do...never. And the result of that fairy tale is the national debt reaching $36 trillion now. That's a 6-fold increase since 1998, just 27 years ago.

So here we are again, and the CBO says this renewal of the 2017 tax cuts will add another nearly $3 trillion to the debt. Congressional Republicans tell us that failing to renew these tax cuts will mean a tax increase for everyone. Well, can that bottom 60% handle $500 less this coming year. Of course, the Musks, Bezos's and Gates's of the world can probably handle $60,000 less.

And most importantly, we wouldn't add $3 trillion to the debt, which has already caused our national credit worthiness to be reduced.

But instead of leveling with us, Congress pretends the only answer is to cut the budget some more. Now I laid out some reasonable cuts to defense we should be talking about:

And the recent devastating attack on Russian bombers by Ukraine, using relatively cheap drones and missiles, shows where future wars are headed. But we continue to invest in the weapons of the past, all of which are incredibly expensive.

I have mentioned before that I have a friend in the Commemorative Air Force, who restore and fly classic old warbirds. He has a son in the actual Air Force who is a B-52 pilot. I asked him several years ago if his son was interested in the then-new B-2 stealth bomber? He said no, because it is so expensive that if he damaged one, he'd spend the rest of his career filling out paperwork.

But that weapons analysis is not happening, and the defense budget is going up, not down. No, we have to cut off Medicaid to 11 million people instead.

The B-B-Bill would also cut nearly $300 billion from the Supplemental Nutrition Assistance Program (SNAP) through 2034, based on Congressional Budget Office (CBO) estimates — by far the largest cut to SNAP in history. As a result of these cuts and other policies in the legislation, millions of people would lose some or all of the food assistance they need to afford groceries, when many low-income households are struggling to afford the high cost of food and other basic needs.

But, hey, these greedy, hungry kids have an extra $500 to make up for it.

The American Prospect points out the bill also includes...

Crippling Courts. The bill, hiding behind the premise that it is an appropriations measure, prohibits any funds from being used to carry out court orders holding executive branch officials in contempt. This is designed to enable Trump and his officials to continue defying court orders. It is almost certainly unconstitutional—if courts have the nerve to say so.

Bonus for the Tax Prep Industry. The Biden administration sponsored a Direct File measure to allow taxpayers to save money by using a free IRS tool to file their tax return rather than paying commercial tax preparers. The program is now available to taxpayers in 25 states. The reconciliation bill repeals the program.

Migrants. The bill adds $45 billion to build immigration jails—more than 13 times ICE’s current detention budget. The bill would allow indefinite detention of immigrant children. It also adds several fees intended to harass. The measure charges families $3,500 to reunite with a child who arrived alone at the border, and a person seeking asylum will have to pay an “application fee” of at least $1,000.

Terminating the Tax Status of Nonprofits. The reconciliation text gives the administration the power to define nonprofits as “terrorist-supporting organizations” and expedite the ending of their tax status. This is ostensibly directed against pro-Palestinian groups, but could be used to suppress the free speech and activism of climate organizations and others.

Blocking State Regulation of AI. The bill prohibits any state or subdivision from passing “any law or regulation regulating artificial intelligence models, artificial intelligence systems, or automated decision systems during the 10-year period beginning on the date of the enactment of this Act.” It requires the repeal of any such laws already on the books.

Gutting the Estate Tax. As if the current exemptions were not enough, the bill raises the no-tax floor to a staggering $15 million for single people and $30 million for couples in 2026. So, a couple could leave $29.99 million to their heirs, tax-free. As recently as 2001, only 2.1 percent of estates paid some tax. With this change, the percentage falls to less than 0.08 percent.

Weakening the Child Tax Credit. The bill nominally increases the current Child Tax Credit from $2,000 to $2,500 per child. But it also lowers the eligibility income threshold, making millions of children ineligible. The bill also excludes from the credit 4.5 million children who have a parent without a Social Security number but who pays taxes with a tax identification number. These children are predominantly U.S. citizens with an immigrant parent.

Expanding School Vouchers. The bill gives $20 billion in the form of tax credits to donors who give money to voucher schools. It also creates a tax shelter from paying capital gains taxes to donors who give appreciated stock to voucher schools. These two provisions amount to a direct federal subsidy to voucher schools using wealthy individuals as a pass-through. This government support for voucher schools comes at a time when Department of Education support for public schools is being slashed.

Stealth Cuts in the Affordable Care Act. The bill allows tax credits that subsidize ACA premiums to expire at the end of 2025. The result will be that out-of-pocket costs for insurance under the ACA will become more expensive and millions of people will lose coverage.

And … Support for Gun Silencers. Buried deep in the bill is a provision that repeals the $200 excise tax on the sale of gun silencers.

Yes, gun silencers. Why? Who the hell knows? Ask Wayne LaPierre.

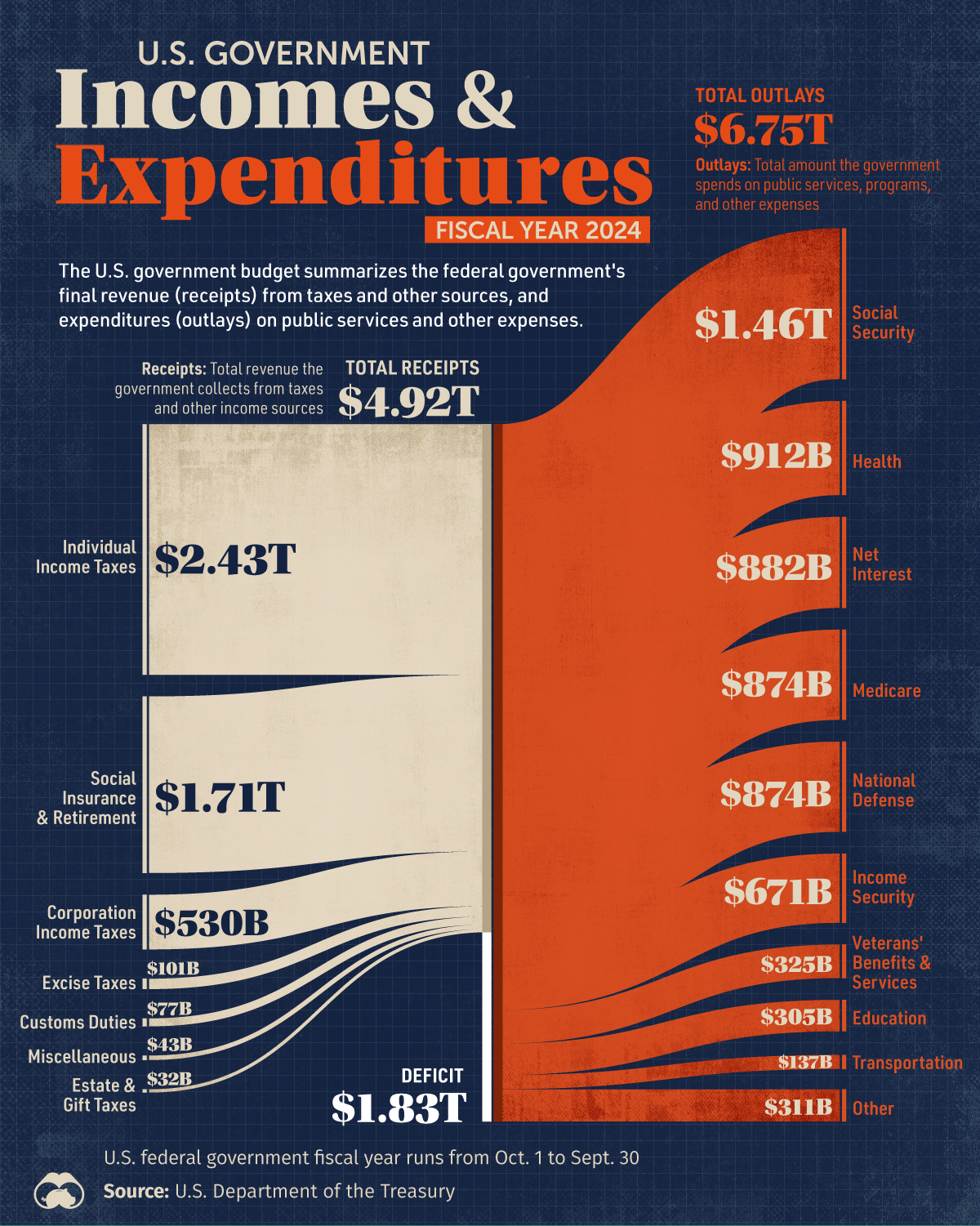

Here's a breakdown of what we take in and what we spend. You can see they aren't even nibbling around the edges.

Oh, and despite the administration trumpeting how few migrants now cross the border, they still want money to build a wall. It's like hitting your car key fob twice to make it extra-lockety.

Meanwhile that walking, talking advertisement for injectables, Homeland Security Secretary Kristi Noem, who can barely move her mouth at this point and can't define habeas corpus, wants active-duty Marines to patrol the streets of Los Angeles. And it's all the fault of former President Gramps or Gavin Newsom or some Democrat somewhere.

And speaking of the "greatest deliberative body in the world," congressional Republicans want to subpoena Gramps' doctor, his wife, hell anyone who seems to have shaken his hand, to find out just how old he was, I guess. Oh, and that autopen thingy, which has been in use in some form or other since Jefferson lived there, is now suspect so maybe his pardons are real? Come on, we still have questions for Hunter.

Oh, and we're not done roughing up Fauci. Yep, FBI Director Kash Patel, and his gang of Lost Boys confiscated Dr. Anthony Fauci's computer and phone this week. They're sure he has Chairman Mao's old phone number in there.

Oh, and let's not forget to dismantle America's oldest and finest university. It's been too liberal for too long. Well, OK, you could simply choose not to go there, but this is more fun.

Yes, it's a busy time ahead for the administration, which seems to spend a lot of time and money looking back. What the heck, let's clear Joe McCarthy's name while we're at it.

They'd have a lot more money for that national rear view mirror, if they rejected the Big Beautiful Bill.

After all, Elon says he's just tapped out.

Now, he is part of the Texas Outlaw Writers, and if this doesn't pan out, the outlaw part will still work as he will indeed resort to robbing banks.